In today’s world of massive corporations and global enterprises generating staggering profits, one key factor driving their investments often goes unnoticed: WACC.

The Weighted Average Cost of Capital (WACC) is a vital concept in corporate finance that plays a pivotal role in shaping a company’s investment strategies and optimizing its capital structure.WACC serves as the benchmark discount rate for evaluating future cash flows.

It’s this metric that helps a business decide whether to pursue a project or pass it up. But how exactly does it influence such decisions?In this guide, we’ll delve into the fundamentals of WACC, exploring how it functions and, most importantly, how you can calculate it using Excel. By the end, you’ll have a clear understanding of this crucial financial tool.

What Is Wacc?

WACC, or Weighted Average Cost of Capital, is a key financial concept composed of two main elements: weighted average and cost of capital.

The term “weighted average” indicates that we are calculating an average, where each component is given a weight based on its proportion within a total. “Cost of capital,” in simple terms, refers to the expense a company incurs to finance its operations.

A company’s capital typically comes from two primary sources: equity and debt. Equity represents the funds invested by the owners or shareholders in exchange for shares, while debt refers to funds borrowed from banks or other lenders.

Each of these capital sources carries its own cost. The cost associated with equity is known as the Cost of Equity (Ke), and the cost associated with borrowing is called the Cost of Debt (Kd). By calculating the weighted average of these costs, based on their respective proportions in the company’s capital structure, you arrive at the WACC, which represents the overall cost of financing for the business.

Formula of WACC

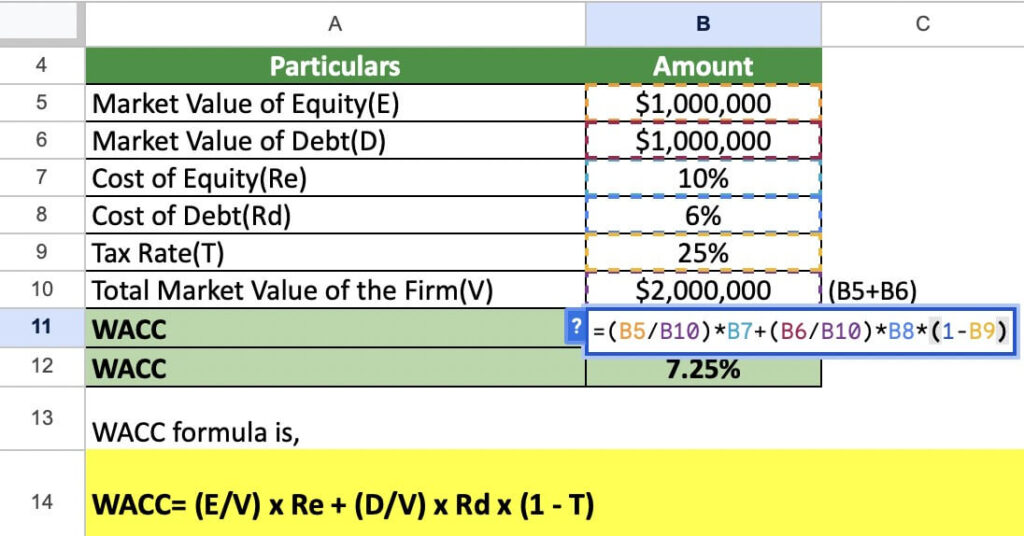

The formula for WACC (Weighted Average Cost of Capital) helps calculate the overall cost of a company’s capital, considering both equity and debt. The formula is

= (Equity / Total Capital) * Cost of Equity + (Debt / Total Capital) * Cost of Debt

A closer examination of the formula shows that we multiply:

– The cost of equity by the proportion of equity in the total capital, and

– The cost of debt by the proportion of debt in the total capital.These two values are then added together.

This forms the basic formula.

However, there is an additional component that takes it a step further:

= (Equity / Total Capital) * Cost of Equity + (Debt / Total Capital) * Cost of Debt * (1 – Tax %)

The only addition is of the Tax percentage deducted from the debt portion of this formula. Why is that? Explained in the section below.

Components of WACC:

- Cost of Equity(Ke):- The return that investors expect for investing in the company’s equity. It reflects the risk of owning the company’s shares.

- Cost of Debt (Kd): – The interest rate the company pays on its borrowings, such as loans or bonds. This represents the expense of financing through debt.

- Proportion of Equity (E/V): – The ratio of the market value of equity to the total capital of the company. It indicates how much of the company’s capital is financed through equity.

- Proportion of Debt (D/V): – The ratio of the market value of debt to the total capital of the company. It shows how much of the company’s capital is financed through debt.

- Tax Shield on Debt (1 – Tc): – The benefit the company receives from the tax-deductibility of interest payments. This reduces the overall cost of debt.

Calculating WACC in Excel

It involves using a combination of basic formulas to input the necessary financial data. Here’s how you can calculate WACC in Excel.

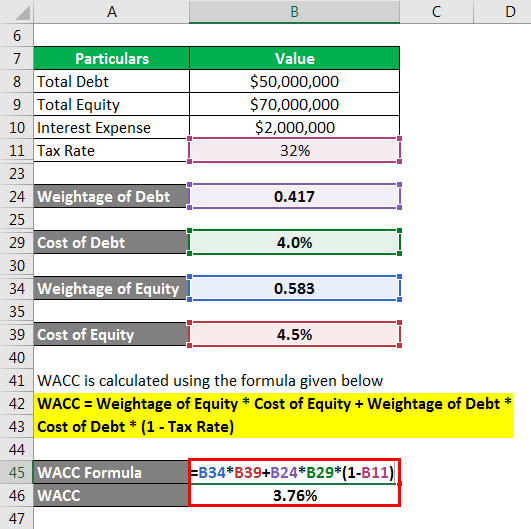

Step 1: Input Required Data

First, set up your Excel spreadsheet with the following columns:

-Equity Value (E): Enter the market value of equity (e.g., share price × number of shares).

-Debt Value (D): Enter the market value of debt (e.g., value of loans or bonds).

– Total Value (V):This is the sum of equity and debt values.

Use the formula: V = E + D

– Cost of Equity (Ke):Enter the required return on equity (typically calculated using CAPM).

– Cost of Debt (Kd): Enter the effective interest rate on debt.

– Corporate Tax Rate (Tc): Enter the company’s tax rate.

Step 2: Calculate the Proportions

Calculate the proportions of equity and debt in the company’s capital structure:

– Proportion of Equity (E/V): Use the formula: =E/V

– Proportion of Debt (D/V): Use the formula: = D/V

Step 3: Adjust Cost of Debt for Taxes

Calculate the after-tax cost of debt to account for the tax shield:

– After-Tax Cost of Debt (Kd × (1 – Tc)): Use the formula: = Kd × (1 – Tc)

Step 4: Calculate WACC

Now, calculate the WACC by combining the weighted costs of equity and debt:

-WACC Formula: = ( E/V ×Ke)+( D/V ×Kd×(1-Tc))

Step 5: Final WACC Calculation

In an Excel cell, input the WACC formula using cell references for each component. For example:- WACC = (B2/B5 * B3) + (B4/B5 * B6 * (1 – B7))

Where:

- B2 = Equity Value (E)

- B3 = Cost of Equity (Ke)

- B4 = Debt Value (D)

- B5 = Total Value (V)

- B6 = Cost of Debt (Kd)

- B7 = Corporate Tax Rate (Tc)

Step 6: Review and Analyze

Once you’ve entered the formula, Excel will calculate the WACC, giving you the weighted average cost of capital for the company.This WACC can now be used for investment decisions, project evaluations, and financial planning.

How To Interpret Wacc In Excel?

WACC, or Weighted Average Cost of Capital, is arguably the most critical financial metric for any business, especially when it comes to making informed investment decisions and evaluating potential projects. It serves as a benchmark that companies use to determine whether an investment or project will generate enough returns to justify the risks involved. In simpler terms, WACC tells a company the minimum rate of return it must earn on its investments to cover the cost of its capital and avoid financial losses.

Understanding WACC is vital because it reflects the overall cost of a company’s financing, considering both equity and debt. These sources of capital come with their respective costs—the return expected by shareholders (Cost of Equity) and the interest paid to lenders (Cost of Debt). By averaging these costs based on their proportion in the company’s capital structure, WACC provides a comprehensive view of the required return threshold.

For example, let’s say your business has a WACC of 8.93%. This figure means that any project or investment you consider should offer at least an 8.93% return to be worthwhile. The rationale behind this is straightforward: your business is effectively paying 8.93% for the capital it uses, so any investment must generate a return that covers this cost. If a project only offers a 6% return, it wouldn’t make financial sense to pursue it. The cost of capital is higher than the return, leading to a loss rather than a profit.

In this context, WACC acts as a hurdle rate—a minimum acceptable rate of return. Projects that meet or exceed this rate can potentially add value to the company, while those that fall below it can erode value. This makes WACC an essential tool in capital budgeting, helping businesses prioritize projects that align with their financial goals.

Moreover, WACC also plays a crucial role in valuation. When estimating the present value of future cash flows, WACC is often used as the discount rate. This ensures that the valuation reflects the true cost of financing those cash flows, leading to more accurate and realistic assessments of a company’s worth.

In summary, WACC is more than just a financial metric; it is a guiding principle that influences a company’s investment strategy, project selection, and overall financial health. By adhering to the threshold set by WACC, businesses can make sound decisions that drive growth and profitability while minimizing the risk of loss.

Conclusion

In conclusion, calculating WACC in Excel is a powerful and straightforward way to assess a company’s cost of capital, combining both equity and debt components. By using Excel’s formulas, you can easily input and adjust key variables like the cost of equity, cost of debt, and the capital structure proportions to determine the WACC accurately.

This calculated WACC serves as a crucial benchmark for making informed investment decisions, optimizing a company’s capital structure, and evaluating the financial viability of projects.

Excel’s flexibility allows for dynamic analysis, enabling you to model different scenarios and assess their impact on the company’s overall cost of capital. Mastering WACC calculations in Excel equips you with a valuable tool for strategic financial management and decision-making.